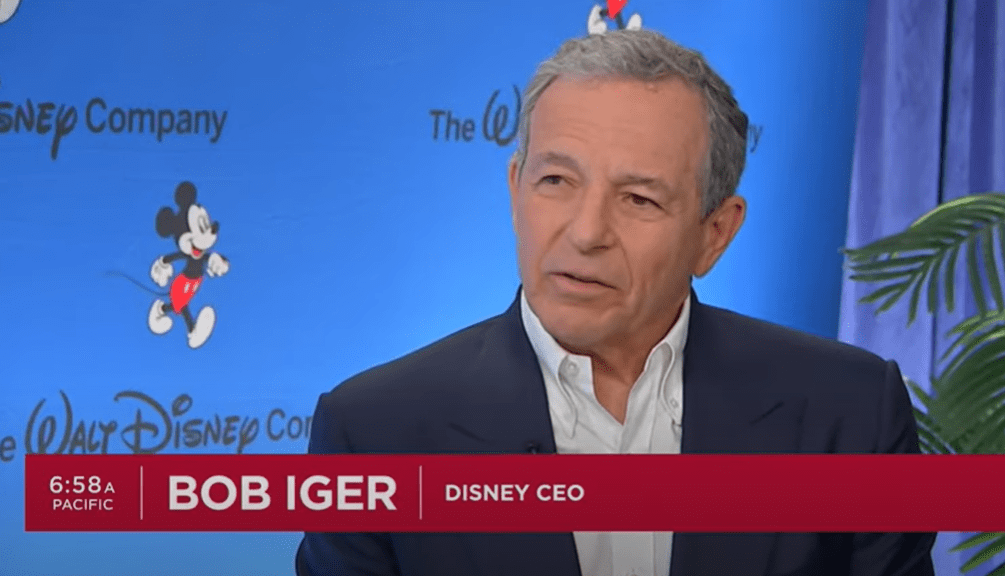

Bob Iger via CNBC Television YouTube

The following article uses data from respected news sources on the web. However, the data ultimately comes from an alleged breach of Disney security. That Park Place never condones illicit and unethical obtainment of corporate data and does not report on such findings until and unless other news sources make it readily available in the public.

The Walt Disney Company has spent tremendous resources on building up the Disney Plus streaming platform into its flagship dissemination tool for nearly all its media. It has sacrificed the Disney Channel for it (though it still remains as a vestigial offering on American cable plans). It has destroyed the secondary market of Blu-Rays and DVDs so that Disney Plus gets all the goods. To a large extent, it has damaged the box office with customers often waiting until they can get it “for free” when it comes to streaming. And yet for all that effort, a new data dump reveals the return on investment for Disney is shockingly bad.

Disney Plus Blades — Courtesy Disney+

According to Reuters, the leaks of Disney Plus financial information are legitimate, even if the means to acquire them are definitively not so:

The leaked files included granular details on revenue generated by products such as Disney+ and ESPN+, park pricing offers and what appears to be login credentials for some of Disney’s cloud infrastructure, the report said. — Reuters

While some of the acquired data is provided in a ho-hum way by various news outlets. A further investigation into what is really being provided shows that Bob Iger’s Disney Plus strategy may be a real albatross for the company.

According to the documents, Disney+ generated more than $2.4 billion in revenue in the quarter which ended in March — or 43% of the revenue generated by the company’s direct-to-consumer business which includes Hulu and ESPN+. — Ariel Zilber, New York Post

First, it’s not certain that ESPN+ is actually included in this number. Disney has separated ESPN into a different category in recent earnings reports. If Disney Plus is generating 43% of all revenues for Disney streaming platforms, that might actually make this situation far worse. You’ll understand why in a moment. More likely, however, is that ESPN+ actually isn’t included in this number… and Disney+ is playing second fiddle financially to Hulu.

HULU ON DISNEY+ CELEBRATION – Some of the biggest stars across The Walt Disney Company celebrate the official launch of Hulu on Disney+ at an exclusive cocktail reception hosted by Dana Walden and Alan Bergman, along with special guest Bob Iger, on Friday evening in Los Angeles. (Disney/Greg Williams)

DANA WALDEN (CO-CHAIRMAN, DISNEY ENTERTAINMENT, THE WALT DISNEY COMPANY), ROBERT A. IGER (CHIEF EXECUTIVE OFFICER, THE WALT DISNEY COMPANY), ALAN BERGMAN (CO-CHAIRMAN, DISNEY ENTERTAINMENT, THE WALT DISNEY COMPANY)

To explain why these numbers are so bad, we need to examine how many Disney Plus subscribers are currently enjoying the service. Our good friends at Statista have that pegged at 153.8 million accounts. So… for an entire quarter, 153.8 million accounts generated $2.4 billion in revenues. Let’s do some more simple math.

For that quarter then, each account generated a total of $15.63 in revenue (on average). It’s easy to determine that simply by dividing the total amount of revenue by the total number of accounts. However, that’s not the full story. For you see, a quarter is three months of time. And Disney Plus accounts pay mostly by-the-month. So how much did they generate in revenue per month instead of by quarter? The answer there is $5.21. So why is that a huge problem?

Well, the lowest subscription plan in the United States to have Disney Plus in your household is going to cost $7.99. It only goes up from there. And accounts paying $7.99 have to watch advertisements. Those ads should be adding to Disney’s revenues for their “flagship” streaming service. Yet the revenues globally per account are on $5.21… far less than the cheapest accounts. This indicates that globally, Disney is taking in miniscule numbers in order to drag that revenue total down to such a degree. The alternative is that, perhaps, Disney is generating far less money than even the lowest subscription plan costs because many of those accounts are perhaps tied into promotions and third party sharing. If vast Verizon customers and Charter subscribers are being counted into the Disney total sub amount, yet they’re not paying for accounts, that’s another way the number could be brought down by this much. I’m not suggesting that’s the case, but something is going on here.

But it gets worse.

(Third from left): Mae Aniseya (Amandla Stenberg) in Lucasfilm’s THE ACOLYTE, season one, exclusively on Disney+. ©.

The breached data is allegedly “revenues”… it isn’t “profits”. While Disney may be scraping by with profitable quarters for streaming in their most recent earnings calls, if Disney Plus is generating $2.4 billion in revenues across an entire quarter, it’s not obvious how Disney can increase the churn of new content without overspending dramatically. Though that money may seem huge, one has to wonder how much the spend is on all of this content and technical wizardry such that they’re barely making it into the black with almost no new content flowing through the gates. Frankly, it doesn’t seem sustainable. But that’s something for investors to decide.